Introduction

Renting an entire residential building can be complex. Whether you’re a tenant seeking space for business or living purposes, or an investor evaluating rental income, understanding 136 93 X How Much To Rent Entire Residential Buildings matters. This guide will walk you through realistic cost expectations, key factors affecting price, negotiation strategies, budgeting tips, and more. You’ll leave with clear insights and confidence to make smart decisions.

Renting an entire building is not like signing a lease for a single apartment. The stakes are higher. You have more space, more responsibilities, and often larger sums at play. That’s why grasping how rents are calculated, the local market influences, and your own financial goals is essential. We’ll break down everything in simple terms so you can act wisely.

Understanding the Concept of Renting a Whole Building

When you rent an entire residential building, you’re taking on all usable units under one lease. This means more square footage, full access, and in many cases, control over how the space is used. From a landlord’s view, it’s bulk income and decreased vacancy risk. From your perspective, it’s flexibility and privacy.

The question 136 93 X How Much To Rent Entire Residential Buildings is rooted in understanding that pricing doesn’t follow a flat rule. It changes with location, building age, the number of units, demand, and comparable rents in the area. We’ll explore these elements so you can gauge realistic prices.

How Market Forces Shape Rental Prices

The first big influence on how much you’ll pay is the real estate market where the building is located. Urban cores with strong demand command higher rents. Suburban towns with slower growth usually have lower rates. Market trends shift with economic cycles, interest rates, and population patterns. When demand peaks and supply is limited, prices go up fast.

Another factor is what comparable properties are charging. Landlords often look at recent leases of similar buildings to set their price. This anchor influences negotiations and defines the range you can expect.

Don’t ignore vacancy rates. High vacancy means lower asking rents. Low vacancy pushes rents up. Always review local market data before committing.

Key Components That Determine the Rental Cost

Every building is unique, but several common components define rental prices:

Location matters more than any other factor. Areas near transit, schools, and amenities tend to cost more. A downtown building that’s fully leased will fetch a premium compared to one in a remote suburb.

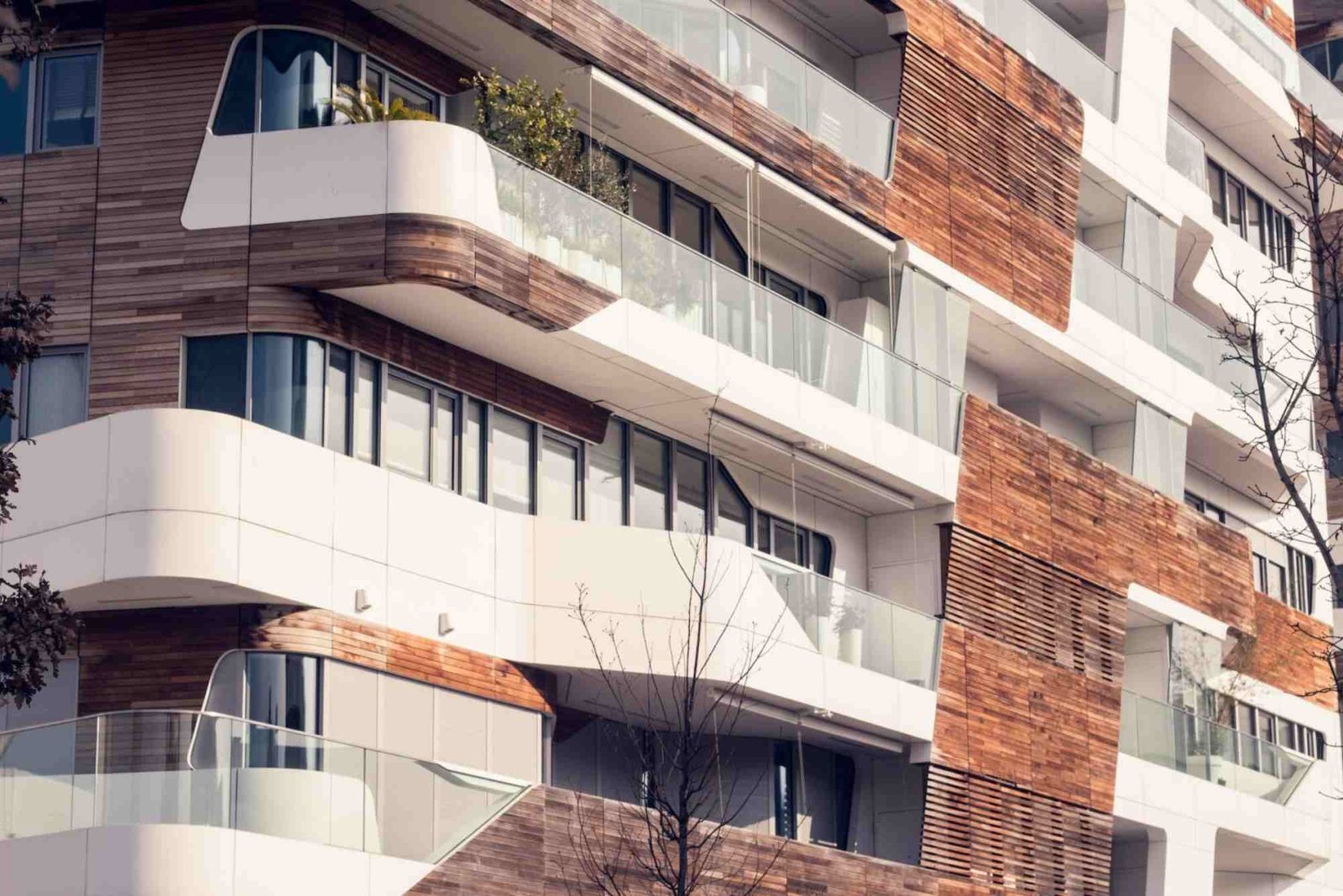

Condition and age of the building drive value as well. Newly renovated or modern buildings attract higher rents. Older structures with outdated systems may be cheaper but could cost more in maintenance.

The number of units and total square footage directly affect price. Larger footprints typically mean higher rent. However, landlords may offer discounts per unit when multiple units are rented together.

Lastly, included services like utilities, maintenance, security, or parking influence the total cost. If the landlord covers more services, expect a higher rent.

Calculating Realistic Rental Estimates

To estimate how much to rent an entire building, start by reviewing the average rent per unit in your target area. Multiply that by the number of units. Then adjust for premium or discount based on condition, amenities, and services.

For example, if comparable units rent at a certain rate but the building has luxury finishes, increase your estimate accordingly. On the other hand, subtract value if major repairs are needed.

The phrase 136 93 X How Much To Rent Entire Residential Buildings should guide you to look beyond surface numbers. True cost includes hidden expenses like maintenance reserves, insurance, and property taxes. An informed estimate accounts for operational realities.

Negotiation Strategies for Bigger Deals

Renting a whole building gives you leverage. Landlords prefer long-term security and consistent income. Use this to negotiate lower rates or better terms.

Always demonstrate financial readiness. Proof of income, strong credit history, and references can position you as a serious candidate. Propose reasonable lease durations that align with the landlord’s goals.

Discuss what utilities and services are included. If the owner tries to shift all responsibilities to you, ask for a rent concession or lower base rate. Effective negotiation balances interests and fosters a win-win outcome.

Financial Planning and Budgeting Tips

Before signing a lease, you need a clear budget. Start with your maximum affordable rent based on your income or revenue projections. Then build in a buffer for unexpected costs.

Factor in property management, repairs, and upgrades. Don’t stretch your budget so thin that you can’t handle surprises. A professionally prepared financial plan protects you from overcommitment.

Also, consider lease escalation clauses. Some leases include annual rent increases tied to inflation or market rates. Understand these ahead of time so you’re not caught off guard by rising costs.

Legal and Contractual Considerations

Lease agreements for entire buildings are long documents filled with obligations. Consulting a real estate attorney can protect your rights. Be clear on responsibilities for repairs, insurance requirements, and termination clauses.

Ensure the contract outlines maintenance standards and who pays for what. Ambiguities often lead to disputes later. A well-drafted lease gives both parties peace of mind.

Case Scenarios: What You Can Expect

Imagine a six-unit building in a mid-sized city. If average market rent per unit is at a certain level, landlords might offer the whole building at a total that provides a slight discount per unit. That’s because you’re filling every unit and guaranteeing income for the landlord.

In a high-demand urban market, however, there may be little room for discount. Here the total rent might closely reflect the sum of individual units with additional premium due to demand and location.

The phrase 136 93 X How Much To Rent Entire Residential Buildings reminds us that there’s no universal answer. Each scenario varies based on the specifics. That’s precisely why informed analysis is essential.

Common Mistakes to Avoid

One frequent error is skipping market research. Without comparing similar buildings, tenants may overpay. Another mistake is ignoring the long-term financial impact of rent escalations and hidden fees.

Failing to analyze building condition can be costly. Older buildings might look cheaper upfront but require frequent repairs that outweigh the savings.

Always read contracts carefully. Overlooking clauses that shift extra costs to you can lead to financial strain. A thorough review and professional advice help prevent regrets.

Benefits of Renting an Entire Building

Renting the whole building can be strategic. You secure total control of the space. You avoid conflicts with other tenants. You can use space for flexible purposes like consolidating teams or operating community-oriented projects.

Landlords benefit too. They reduce marketing and turnover costs. You gain predictability and potential cost savings when units are bundled into one lease. Before committing, weigh these benefits against your financial realities and goals.

Tools to Evaluate Rental Value

Use local rental reports and online real estate platforms to benchmark prices. Talk to property managers and agents familiar with the area you’re targeting. They often share insights that numbers alone can’t reveal.

Calculating rent as a percentage of replacement cost or comparing cap rates for investment properties gives deeper perspective. Evaluate both economic and qualitative factors.

Don’t forget to check legal requirements for zoning and permitted use. Some residential buildings have restrictions on how space can be used, which may affect your operational plans.

How to Approach Landlords Professionally

Professional communication can make a difference. Present a detailed proposal that outlines your intended use, financial capability, and lease term preferences. Be respectful and transparent.

Ask questions about the property’s maintenance history, tenant turnover, and any planned upgrades. This demonstrates seriousness and helps build trust. Your goal is to establish a relationship that fosters collaboration throughout the lease term.

Understanding 136 93 X How Much To Rent Entire Residential Buildings isn’t about memorizing a number. It’s about learning how markets work, how rent is influenced, and how to negotiate and plan wisely. Armed with these strategies, you can confidently approach building rental opportunities with clarity. If you’re ready to explore more insights on real estate costs, check out this Related Blog article

Have questions or want advice tailored to your situation? Visit our category page for more expert guidance: 136 93 X How Much To Rent Entire Residential Buildings.

Ready to dive deeper into market research? Learn more and keep making informed decisions.

FAQs

How do landlords price entire residential buildings?

Landlords consider location, building condition, market rents, number of units, and included services. These elements combine to set a competitive and fair price.

Is renting an entire building cheaper than individual units?

Often, landlords offer a small discount per unit when all units are leased together. However, this depends on demand and market conditions.

What hidden costs should tenants expect?

Hidden costs include maintenance, utilities, insurance, property taxes, and rent escalations. Clear contract terms help avoid surprises.

Can I negotiate rent for a whole building?

Yes. Present your financial credibility and long-term lease intentions to negotiate better terms. Landlords value steady income.

What’s the first step before signing a building lease?

Research local rental rates and review the lease with a real estate professional. Understanding market trends and legal obligations protects you.